Peter Allan Atkins

Awarded Practice Areas

Biography

Peter Allan Atkins is an internationally recognized leading attorney involved in the firm’s corporate and securities practice areas, with extensive experience in the mergers and acquisitions, and corporate governance fields. He has represented acquirors (both U.S. and non-U.S.), targets and investment banks in a large number of mergers, acquisitions, takeovers (negotiated and contested), leveraged buyouts, spin-offs and joint ventures. He also counsels clients on a broad range of corporate, securities and business-related matters, including directors’ duties and responsibilities and other aspects of corporate governance, disclosure issues, corporate compliance matters and internal investigations. This advice often is provided to boards, independent directors and special committees of directors in crisis situations and where the satisfaction of their fiduciary duties is subject to particular scrutiny.

Mr. Atkins has had substantial transactional involvement in numerous industries, including airline, defense and aerospace, energy, financial institutions, forest products, health care, information technology, insurance, media and telecommunications, retail and utilities.

Mergers and Acquisitions: Mr. Atkins has advised clients on numerous major proposed and completed transactions, including the representation of: BHP Billitonin its attempted $150 billion acquisition of Rio Tinto; Sprint Corporation’s financial advisor in the attempted $129 billion business combination between Sprint and MCI Worldcom; Warner-Lambert Company in its attempted $72 billion merger-of-equals with American Home Products Corporation and its response to Pfizer Inc.’s intervening proposal to acquire Warner-Lambert for $84 billion; Bell Atlantic Corporation in its $70 billion wireless joint venture with Vodafone AirTouch Plc; Walt Disney Company’s financial advisor in connection with Comcast Corporation’s interest in acquiring Disney for $66 billion; Bell Atlantic Corporation in its $57 billion merger-of-equals with GTE Corporation; Global Santa Fe Corporation in its $53 billion merger-of-equals with Transocean Inc.; Honeywell International, Inc..in its attempted $45 billion acquisition by General Electric Company; and RJR Nabisco, Inc.’s special committee in the RJR auction and ultimate $25 billion leveraged buyout by Kohlberg Kravis Roberts & Co. Mr. Atkins also represented The Dolan family (as co-counsel) in its attempted $22 billion going-private transaction with Cablevision Systems Corporation; a private equity consortium led by The Blackstone Group in its $17.6 billion acquisition of Freescale, Inc.; Infinity Broadcasting’s special committee in the $15 billion acquisition by Viacom of Infinity’s public minority shareholder interest; Honeywell Inc. in its $14 billion business combination with AlliedSignal Corporation; Time Inc. in its successful $12 billion acquisition of Warner Communications Inc. and defense against Paramount Communications, Inc.’s takeover bid; UST Inc. in its acquisition by Altria Group, Inc. for $11.7 billion (including $1.4 billion of assumed of debt); AMP Incorporated in its $11.3 billion business combination with Tyco International Ltd. and in its successful defense against AlliedSignal’s $10 billion unsolicited takeover bid; TRW Inc. in its $10 billion acquisition by Northrop Grumman Corporation at a value substantially above the initial unsolicited bid; and Martin Marietta Corporation and its financial advisor, Bear Stearns & Co., in the $10 billion business combination between Martin Marietta and Lockheed Corporation; Lockheed Martin Corporation in its $9 billion acquisition of Loral Corporation’s defense business; Great Western Financial in its $7.5 billion business combination with Washington Mutual and in its successful defense against H.F. Ahmanson’s unsolicited $6.5 billion takeover bid; Merck KGaA in its approximately $7.2 billion acquisition of Millipore Corporation and in the sale of its global generic drug business (via an auction process) for $6.7 billion to Mylan Laboratories Inc.; Knight-Ridder Inc. in its $6.5 billion acquisition by The McClatchy Company; Waste Management, Inc. in its attempt to acquire Republic Services, Inc. for approximately $6.2 billion; Western Gas Resources, Inc. in its $5.3 billion acquisition by Anadarko Petroleum Corporation; UAL Corporation in its $5 billion majority employee ownership transaction involving a large-scale ESOP; The Hughes Medical Foundation in its $5 billion sale of Hughes Aircraft Company to General Motors Corporation; and Kmart Corporation in its $4 billion financial restructuring. In addition, Mr. Atkins advised Fort Howard Corporation’s special committee in the company’s $3.6 billion leveraged buyout by Morgan Stanley & Co. Incorporated’s LBO fund; International Business Machines Corporation in its $3.5 billion acquisition of the global consulting business of PricewaterhouseCoopers; Campagnie Generale de Geophysique in its $3.1 billion acquisition of Veritas DGC Inc.; and The Bear Stearns Companies Inc. in its acquisition by JPMorgan Chase & Co. in an all-stock merger valuing Bear Stearns at approximately $1.2 billion. Other companies that Mr. Atkins has represented include Belridge Oil Company; Boise Cascade Corporation;Campbell Soup Company; Ceridian Corporation; China National Offshore Oil Corporation; Cinergy Corporation; Duke Energy Corporation; Entergy Corporation; Intermedia Corporation; Noble Energy, Inc.; Pacific Enterprises, Inc.; Santa Fe Pacific Gold Corporation; Softkey International; Textron Corporation; Thomas H. Lee Partners; and Xerox Corporation.

Corporate Governance: Mr. Atkins’ corporate governance-related experience includes advising boards of directors and board committees regarding the changing corporate governance environment and regarding current and prospective governance requirements and attitudes (including under Sarbanes-Oxley, SEC rules, NYSE/NASDAQ rules and state law).

Representative corporate governance situations involving crises or the prospect of particular scrutiny regarding whether directors satisfied their fiduciary duties include:

- Special committees responding to related party buyout, or controlling shareholder minority takeout, proposals (e.g., Maguire Properties, Inc.; Edison Schools; US Unwired Inc.; Seminis Inc.; RJR Nabisco, Inc.; Infinity Broadcasting Corporation; Azurix Inc.; Jostens Inc.; Fort Howard Corporation; and Telerate, Inc.);

- Target company boards responding to unsolicited takeover bids or shareholder activism(e.g., The Brink’s Company; NRG Energy, Inc.; TRW Inc.; AMP Incorporated;Warner-Lambert Company; Time Inc.; Great Western Financial; OfficeMax;PP&L Resources, Inc.; PSI Resources, Inc.; The Mead Corporation; and Carter Hawley Hale Stores, Inc.);

- Boards of financially distressed companies (e.g., The Bear Stearns Companies Inc.;Delphi Corporation; Refco Inc.; Interstate Bakeries; RCN Corporation; Kmart Corporation; US Airways Group, Inc.; Sierra Pacific Resources, Inc.; UDC Homes, Inc.; and Aurora Foods, Inc.); and

- Boards of companies responding to claims of accounting improprieties/corporate misconduct (e.g., Affiliated Computer Services, Inc.; Enron Corporation; Kmart Corporation; HealthSouth Corporation; and McKesson Corporation).

Firm Role; Professional Activities: Mr. Atkins is involved in the firm’s senior management, including as a member of the firm’s Policy Committee. He writes and lectures on corporate and securities topics, including mergers and acquisitions and corporate governance.

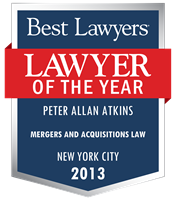

Leading Lawyer Recognition: Mr. Atkins repeatedly has been recognized as a “leading lawyer” in the M&A and corporate governance fields by, among others,Chambers Global (Star Individual); Chambers USA (Band 1); The International Who’s Who of Corporate Governance Lawyers; The Legal 500 U.S.; IFLR1000; and The Best Lawyers in America. He also was named Best Lawyers’ “2013 New York City Mergers & Acquisitions Lawyer of the Year.”

Overview

- Harvard University, LL.B.

- New York, New York State Bar Association

- A Better Chance, Board of Directors - Member

- Board of Advisors, Harvard Law School, Forum on Corporate Governance and Financial Regulation - Member

- Dean’s Advisory Board, Harvard Law School - Member

- New York Regional Board, Anti-Defamation League - Member

- New York, New York State Bar Association

- A Better Chance, Board of Directors - Member

- Board of Advisors, Harvard Law School, Forum on Corporate Governance and Financial Regulation - Member

- Dean’s Advisory Board, Harvard Law School - Member

- New York Regional Board, Anti-Defamation League - Member

- Harvard University, LL.B.

Client Testimonials

Awards & Focus

- Mergers and Acquisitions Law, New York City (2013)

- Corporate Law

- Leveraged Buyouts and Private Equity Law

- Mergers and Acquisitions Law

- Securities / Capital Markets Law

- Securities Regulation

- Mergers & Acquisitions

- Securities

News & Media

Your browser is not fully compatible with our automatic printer friendly formatting.

Please use the print button to print this profile page.